Whether it’s forgotten whistle stops along Route 66, back roads through New England foliage, or byways off the beaten paths in the United Kingdom and Europe, my husband and I never end one road trip without mapping out the next. And, with a more flexible time schedule in retirement, we’re ready to explore some bucket-list destinations that time restrictions during our working years never allowed.

Always mindful of our travel dollars, we have stumbled upon some less obvious ways to cut costs as we plan our future trips. In addition to early-bird specials and AARP discounts, of course, here are some strategies we’ve put into practice:

#1. It Pays to be a Hotel Brand Groupie

We recently discovered the advantages of hotel brand loyalty. Whether you choose Hilton Honors, Best Western Rewards, IHG Rewards or the loyalty program for LeClub Accor Hotels, there are significant perks to frequenting one hotel chain. In addition to discounts, upgrades, and free nights, being a loyal member of one of these brands guarantees a comfortable and familiar place to stay when traveling abroad. Furthermore, these same companies maintain hotels in many countries around the globe.

We love the fresh face the new Holiday Inn Express and Best Western Plus hotels have brought to their prospective chains in the past decade. There’s a warm and welcoming vibe in most of these newer hotels. Spacious rooms, lofty ceilings, contemporary decor, and freshly laundered duvets on pillow-top beds are a few of the new features. And, the complimentary breakfasts these hotels offer have set a new industry standard with their broad variety of hot and cold selections for health-conscious as well as hearty eaters. As Rewards members for both chains we appreciate that these companies’ rewards points never expire.

Apply for Hilton Gold Membership with a Status Match

However, our loyalty currently lies with Hilton Honors for several reasons. Earlier this year I discovered most hotel brands offer an opportunity for a status match. That is, a gold member of one company can request equal or higher status at a competing company with all of the accompanying benefits. Our frequent patronage of Holiday Inn Express quickly earned us Gold Elite Status through the IHG chain. Then, when I requested an equal status match at Hilton Hotel properties, we converted our Hilton Honors Silver Status to Hilton Honors Gold. This status was contingent on three stays within a three-month period. However, now that we’ve experienced Hilton Hotels as gold-level members, we don’t want to return to silver status any time soon.

Before, as the proverbial cheapskates, we only booked rooms at Hilton’s Hampton Inns or Embassy Suites which featured complimentary breakfasts. However, with Hilton Honors Gold Status, complimentary breakfasts come with stays at any Hilton property including Waldorf, Hilton, DoubleTree, Garden Inn, and the landmark Curio and Tapestry hotels. In addition, when space is available, we’ve taken advantage of free upgrades to the executive level with access to the executive lounge. This perk takes breakfasts and evening happy hours to a new level of extraordinary experience for two ordinary folks like us.

Best of all, our Hilton Honors Gold Status earns us an additional 80% bonus points above our base points per each dollar spent at all Hilton properties. This translates to a free reward night four times faster than with the 20% bonus points as Hilton silver members. In fact, Hilton Honors Gold Status members earn reward nights more quickly than almost all of the other chain rewards programs. We are happy Hilton groupies as our 12-day trip through the New England Fall foliage in October included four free nights, first at the Hilton Curio property in Saranac Lake, New York, and then at the Doubletree Bedford Glen, a short distance out of Boston.

There’s a catch, of course.

To retain gold status for the following year, Hilton requires 40 nights or 20 stays within the year–an unrealistic goal for most retirees traveling on a limited budget. However, once we experienced first-hand the advantages the gold level offered, we abandoned our old credit card of 25 years for a new Hilton’s Honors American Express Surpass Card. We researched this move carefully and four months in, we have no regrets.

First and foremost, our Hilton Honors American Express Surpass Card guarantees us gold status and all of its privileges at Hilton Hotels for as long as we retain the card. Traveling is our primary goal for our first decade as retirees, so this perk rises above other credit card offers.

Although we’re paying a $95 annual fee for our new Surpass Card, we’ve already recouped our loss. Years ago we formed the habit of paying bills and other expenses with our credit card and reaping the points as we paid it off at the month’s end. With our initial enrollment with Surpass, we earned a complimentary 130,000 points, and because we use this card for all of our purchases, we’ve earned many more in the months we’ve relied on the card.

In addition to the 12x points earned for dollars spent at Hilton properties, we earn 6x points for eligible purchases at U. S. gas stations, supermarkets and restaurants and 3x for all other eligible purchases (including any stays at our two other favorite hotels, Holiday Inn Express and Best Western Plus). An added perk is the pre-flight access to hundreds of airport lounges around the world. A complimentary gold card accompanies the Surpass card and allows ten free passes each year that can be used by the holder and the guests who accompany him or her, featuring up to $30 in food and drinks per person.

I’ll say it again—when we manage our monthly expenses with our American Express Hilton Honors Surpass card, we earn points even faster. In addition to our four free nights in New England, we booked two free Hilton rewards nights in route to Angel Fire, New Mexico in August. That’s nearly a week of free lodging with savings of over $800, a cheap travel trick worth the effort.

#2. Cheap Tricks for Air Travel

Due to the variance in taxes and fees, some airports are cheaper to fly out of than others. Go Banking Rates‘ highlights some of these cheaper flight opportunities in the recent article Top Ten Cheapest Airports, but we’ve made some discoveries of our own.

Year after year, as I planned group trips to Europe, I plugged various departure and return routes into airline search engines to help me determine which flights might be cheaper. I quickly noticed that flying into London Heathrow or Gatwick and flying out of another city on the European continent, is significantly less expensive than flying into other European cities and flying out of the London. The culprit is the government-imposed Airport Duty Tax (APD) that all passengers flying out of the United Kingdom must pay. The UK’s tax is the highest in the world. For instance, on the day I booked our group fare for our upcoming trip to Europe with family and friends, our tickets were $190 cheaper flying into London and flying out of Zurich, Switzerland, rather than the reverse departure and return.

Consider AerLingus for Your Next Flight to Europe

But, if your goal is to explore Europe with only a companion or two and you have additional travel days to spare, consider the value of AerLingus Airlines’ flights from the United States, and make Dublin, Ireland, your gateway city in Europe. You always wanted to go to Ireland anyway, right?

We’ve only flown on AerLingus twice, but we are enthralled with its charm, from the attendants’ Irish lilt to the melt-in-your-mouth Kerrygold shortbread. In addition, AirlineRatings.com editors recently included Aerlingus on their top ten list of safest low cost airlines.

Booked from the AerLingus website, a direct flight, round trip from Chicago to Dublin, is often under $500. An additional leg from an airport closest to your home base may add $200 to $250 to the round trip cost; however, the savings comes with the round trip flights from Dublin to many European cities—often less than $100 per person. For instance, at this writing, a Saturday to Saturday flight in the spring from Dublin to London is 60 Euros (approximately $68); Dublin to Amsterdam, 72 Euros ($81); Dublin to Paris, 82 Euros ($92), or Rome, 105 Euros ($118).

Studying the options on the AerLingus website and booking the flights yourself could keep your roundtrip fare to Europe substantially under $1000 (factor in the conversion from Euros to dollars when booking these second flights). Choose a flight with an earlier morning arrival in Dublin and book a later afternoon flight to your next destination. Or, include an overnight stay or two in Dublin, hardly an inconvenience when nearly every destination on this small and magical island is not only affordable but within a half-day’s travel.

Always scroll down on the AerLingus site first and browse their travel deals. The company will often have flight and rental car package for two.

Update: Friends of ours just returned from their trip abroad and upon our advice, booked Aer Lingus. They give it two big thumbs up.

#3. Cheap Tricks for International Travel

Whether you are gearing up for overseas travel or heading north or south of the United States’ border, unnecessary data charges and currency exchange rates can shrink your travel dollar significantly.

Saving $$$ on International Data

For years, we considered the roaming charges we paid to access data abroad a necessary evil of traveling, trip after trip. As faithful customers of ATT for 25 years, we paid $200 or more the months we traveled internationally or took a cruise. That was in addition to the cost of the international data plan we purchased for two phones.

Although ATT does an exemplary job informing customers about its international charges, those customers still pay .25 cents per 1MB of data when when traveling abroad. So, on a typical day of international roaming—inadvertently downloading only 50 of those unsolicited email in your in-box, accessing google maps for navigation and other online travel resources, and posting pictures on Facebook to communicate with your friends and family back home—you could easily exceed 100 MB and add $25 or more to your bill per day. For a ten-day trip, your bill could exceed an additional $250 or more for that month.

Just recently we discovered T-Mobile’s Magenta 55 plan and we made the switch. We are now saving $116 a month—that’s nearly $1400 a year compared with our previous ATT monthly bills. For $70 a month we have two lines, unlimited talk, texting, and 4 G data, and a hotspot with 3GB of data at 4G (unlimited 3GB afterward). But even better, that same $70 month also includes unlimited international texting and guaranteed international 2G data, plus unlimited in-flight texting and one hour of in-flight wi-fi.

Note, too, that $70 a month includes taxes and fees. Upgrade to T-Mobile’s Magenta 55 Plus for $20 a month and you’ll get even more perks.

Trimming Costs on International Exchange Rates

Converting your hard-earned cash to foreign currency is one of the quickest and unexpected ways to deplete your travel budget. The service is never free, but some venues that specifically target travelers are more costly than others. Here are a few simple rules for keeping more money in your pocket:

First, access websites like XE Currency Converter or X-Rates and study the live dollar exchange rate for the country or countries to which you are traveling. These rates are always fluctuating, and it’s important to know the current rate as you consider your options for the cheapest exchange.

Second, keep in mind that credit cards with no foreign transaction fees seem to provide the best rate of exchange when converting dollars to foreign currency. Furthermore, because carrying large amount of cash is a risk, relying on plastic is a safer way to travel. Cards like Capital One’s Quicksilver or Venture and Chase Manhattan’s Sapphire Preferred usually provide a rate of exchange closest to the current wholesale market rate while waving the 1 to 3% transaction fee that other cards charge.

Debit cards also provide a favorable rate, often nearly par with the wholesale market rate. Take note, however; these cards are subject to the sponsoring bank’s transaction fee, usually a minimum of 1 to 3% of the transaction. Travelers should always contact the credit card company or bank one week before departure to avoid interrupted service. Those relying on a debit card should enlist the assistance of their home bank to identify ATMs in the foreign destination that won’t charge surprise “service fees” above the minimum 1 to 3%.

Although credit and debit cards provide the best rate of exchange, smart travelers should always have a small amount of foreign currency in their pockets when they arrive at their destination for a variety of reasons. Some businesses won’t accept credit or debit cards and others won’t accept them for minimum purchases. For that reason, you should always have enough cash for a couple of meals, cab fare, and emergency personal items.

If stretching your dollar is your priority, avoid purchasing this cash at the airport or any “currency store” including Travelex, which charge customers more for the convenience they provide. Undoubtedly, your local bank will provide the best rate of exchange for foreign currency for approximately 10% over the market price. Make sure you arrange for this purchase at least two weeks prior to your trip to avoid a fee of $20 or more for expediting your purchase.

#4. Upscale Travel is Cheaper Sunday through Thursday

It may be common sense, but it merits repeating: hotel rates are usually cheaper when the weekend crowd goes home. This simple fact always determines our travel routes.

For example, our New England trip several weeks ago included several nights in upscale hotels with history and character, more affordable because we chose week-night stays. We loved our time at the Ocean House Hotel at Bass Rocks, a century-old establishment in Gloucester, Massachusetts, overlooking the Atlantic and listed on the National Register of Historic Places, but we paid considerably less on a Thursday night. A Friday or Saturday check-in at the Ocean House commands $130 more per night than a room during the week.

And, although we cashed in our Hilton points for our stay at Hilton’s iconic Hotel Saranac in New York state’s Adirondack mountains, we stretched our points further by choosing a Tuesday and Wednesday night stay over a weekend stay, more than a $300 difference.

In addition, four of our routes through Europe in the past decade have included dinner and a night in a 4-star castle hotel, affordable because rates on Sunday through Thursday are substantially less than the weekend rate. We have happy memories of our night in Ruthin Castle in northern Wales, Burg Colmberg in the Bavarian Alps, and Chateau de Bricquebec in Normandy. Our visit to the Chateau Fort de Sedan in the Ardennes region of France even included a moonlight tour by torch.

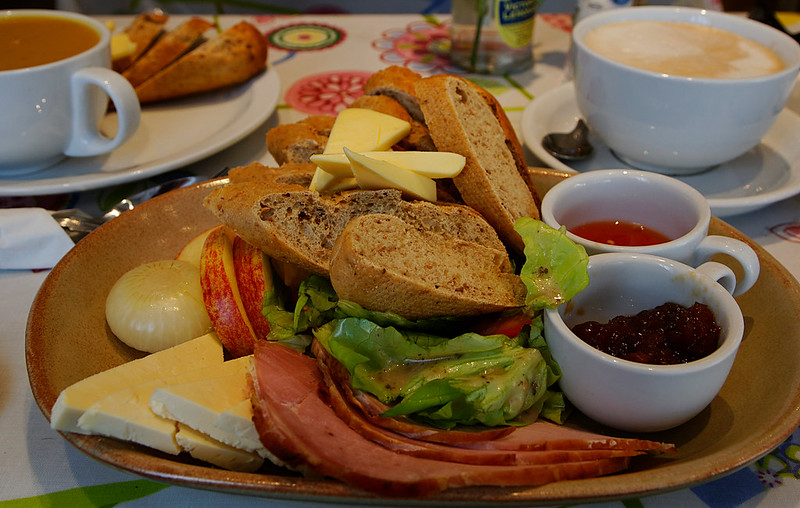

#5. Eat Cheaper with a Ploughman’s Meal

Restaurant meals take a big bite out of a travel budget–no pun intended. We make sure breakfast is always included with our hotel stay, and as a rule, lunch is the only meal we eat in a restaurant. Not only are noon meals usually less expensive, our aging tummies can no longer handle a heavy evening meal.

On the contrary, our suppers have evolved into a simpler treat we fondly refer to as a ploughman’s meal. Common pub fare in England, the British get the credit for this term although people have eaten this way for centuries–at least before processed and packaged food became the norm. Served on a cutting board with a knife, the traditional meal is often shared. It consists of a hunk of hearty bread, sliced roasted ham or beef, a wedge of cheddar, and pickles, butter and chutney, with sliced fresh vegetables and fruit.

Of course, our version of the ploughman’s meal may deviate a bit from the original. In fact, it’s actually a new twist on the meals our families ate on the road when we were kids growing up in the 1960s. We were both raised on teachers’ salaries and restaurant meals were a rare treat. The only way our families afforded vacation time was if all of our meals came from the big wicker picnic basket and the old Igloo cooler.

We now have a small collapsible tote that fits easily in a suitcase if we’re traveling by plane. Hunting for a local market and perusing the aisles for delicacies we can’t find on the shelves back home has added an extra dimension of fun to our travel: a loaf of brown grainy bread, a couple of wedges of fancy cheese or butter, berries or pears, beefsteak tomatoes or English cucumbers, lemon curd or apple chutney — whatever happens to be in season or catches our fancy. Even if we go overboard, and we often do, the cost for our evening meal from a market is far less than what we would pay in a restaurant.

And, as the day winds down, we relish the joy of relaxing in the comfort of our hotel room with our simple supper laid out in front of us. We add a pot of tea or a bottle of beer, and find ourselves intrigued with what happens to be on the television—CSI with English subtitles or newscasters with interesting accents. We won’t pretend we lead a more glamorous life. We’re old and our joints hurt, but we’re happy we’ve stretched our dollars a bit further for our next round of cheaper travel.